In today’s evolving economy, the lines between industrial real estate and supply chains are increasingly blurred. Industrial or Commercial real estate is no longer just about location or price—it’s about logistics performance, proximity to demand centres, multi-modal connectivity, and future-readiness, comfort of delivery, catchment etc. This is where real estate consultants play a transformative role. Backed by data, they help businesses navigate the property market not just to find space—but to unlock strategic supply chain value.

Data Is the New Currency in Commercial Real Estate

Gone are the days when location alone determined a property’s worth. Today, top CRE consultants analyze a mix of data points—rental yields, absorption rates, infrastructure development, and demand-supply dynamics—to provide clients with a comprehensive picture. Whether it’s identifying emerging logistics hubs or upcoming micro-markets for office spaces, data plays a central role in investment or even leasing decisions.

This empowers corporates, SMEs, and institutional investors to assess not just the current value of a property but its future growth potential.

Treating Commercial Real Estate Like a Supply Chain

Just like modern supply chains track inventory flows and delivery timelines, smart consultants view the CRE market with a similar lens. They study the inflow of new inventory—such as Grade A office stock, industrial parks, or warehousing units—against real-time demand.

For instance, if a logistics cluster sees rapid warehouse occupancy and limited new supply, it may signal an opportunity for early investment. Conversely, if a business district shows oversupply with stagnant absorption, it’s a sign to tread carefully.

From Gut Feel to Forecast Models

Commercial real estate investments now rely on more than market chatter. Consultants use predictive analytics and industry dashboards to forecast trends. If a port-adjacent industrial belt is set to benefit from new cargo-handling infrastructure, or if a new airport expressway is expected to boost retail footfall in a region—these are insights drawn from structured tools, not assumptions.

This helps clients optimize entry and exit timing and identify high-growth corridors early on.

Hyperlocal Intelligence = Better Returns

Even within the same city, one industrial block may outperform another due to better truck access, power reliability, or fewer legal bottlenecks. That’s why leading consultants drill down into hyperlocal details—logistics congestion, transport linkages, workforce accessibility, compliance clarity, and more.

This on-ground intelligence ensures businesses invest in commercial spaces that support operational efficiency and long-term growth.

Real-Time Demand Signals Guide Strategy

Digital footprints can be powerful indicators. By monitoring real-time online searches, property portal trends, and developer launches, consultants detect rising interest in specific zones. For example, a sudden spike in commercial inquiries around a suburban flex-office hub could indicate shifting occupier preference or a post-infrastructure development bounce.

Tapping into such trends early gives business buyers and institutional clients a head start—often before price escalations begin.

Beyond Brokerage: Strategic CRE Advisors

In today’s data-first environment, commercial real estate advisors do more than just match businesses to buildings or cargo to warehouses. They act as strategic partners—offering insights that reduce risk, highlight opportunity, and align property decisions with business goals.

Whether it’s expanding a retail footprint, acquiring a logistic park, or investing in a pre-leased commercial asset, working with a data-led consultant can be the difference between an average deal and a high-performing asset.

In a world shaped by fast-moving supply chains and economic shifts, one thing remains clear—in commercial real estate, data is no longer a bonus. It’s the backbone of smart investing. A decision backed by Data using AI tools helps the modern age consultants to guide the best to their customers and hence enhance the service quality and helps in achieving the short and long term property goals.

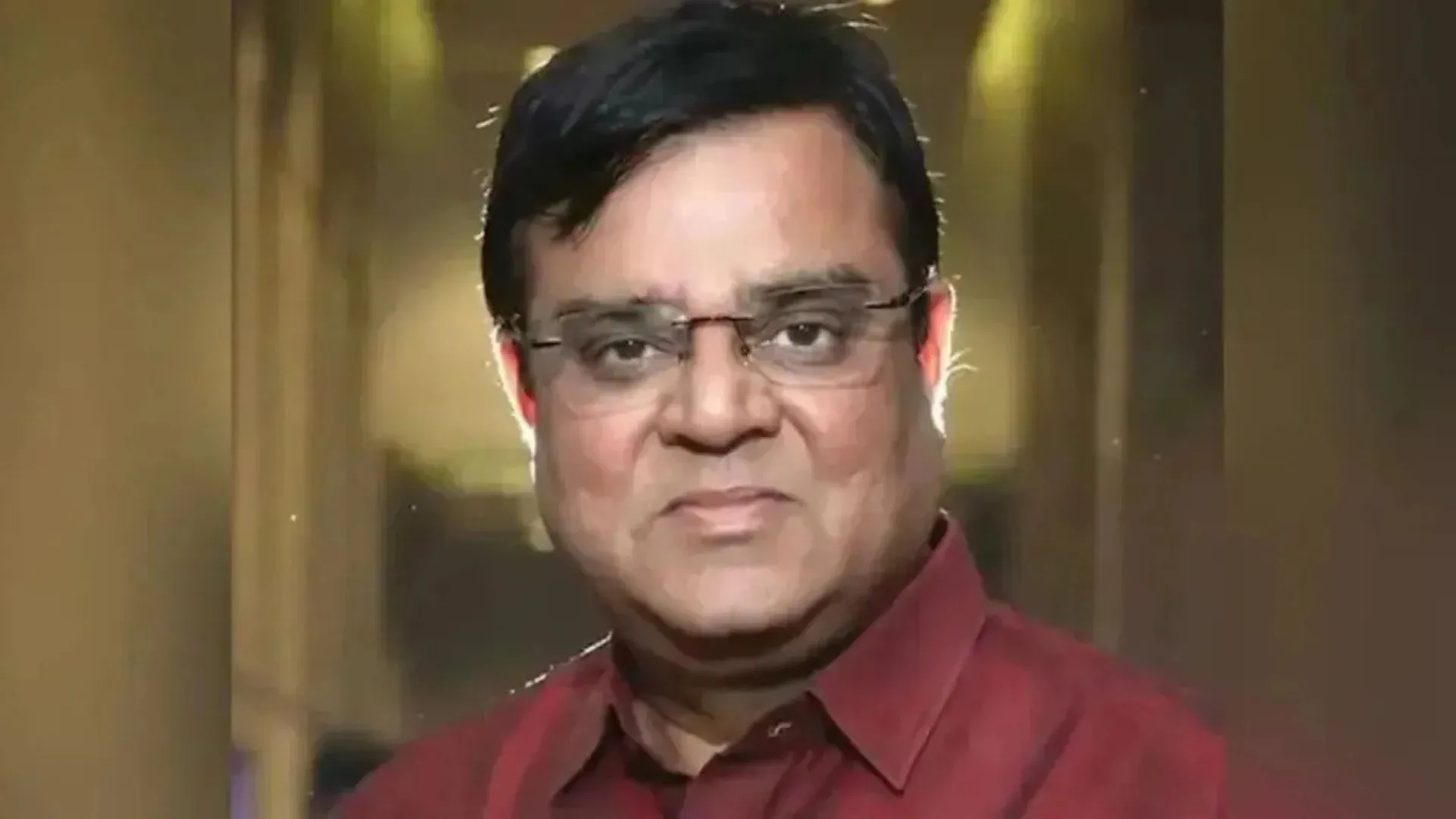

(Authored by Zafeer Ahmed – Managing Director, XRE Consultants)